Blockchain based Credit Card Payment Processing System

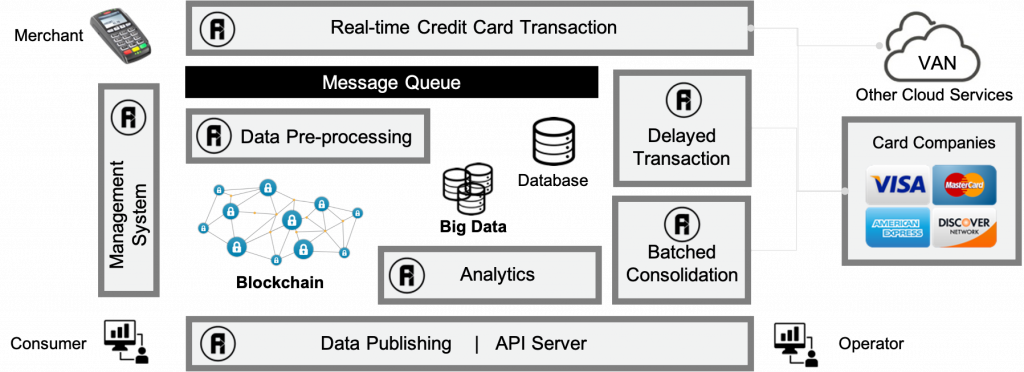

Solution Architecture

Solution Summary

The leading fintech companies today are defining the API taxonomy in a way that creates a common language that’s understood by both business and technical units. The key is to distinguish between APIs that directly serve the business (where business input is crucial) versus those that are technical enablers. This is in contrast to APIs historically classified as middleware that integrated and exchanged data among multiple systems. Because most API efforts were housed in the IT group, the taxonomy used to classify them was usually technical and nonintuitive. This prevented business stakeholders from engaging in API design and prioritization.

The result of API taxonomy is reduction of API analysis time by 50 to 75 percent, increase adoption by 30 to 50 percent, and increase value realization by 25 to 50 percent.

A solid taxonomy allows businesspeople to have conversations with IT staff about which APIs directly drive customer experiences and which are part of the infrastructure that enables delivery of those experiences.

Development Effort

- Total Time: 6 months

- Resources: 3 engineers

Business Benefits

- Time Savings: 6 months

- Cost Savings: $500,000

*Estimates based on a traditional development method

Products used

- API AutoFlow Cloud

- API AutoFlow On-premise

Services Subscribed

- Development Services

- Solution Support Services

About the Customer

Company name undisclosed

0 Comment

-

Leave A Comment :